- Employee Management

Understanding the new coronavirus job retention scheme (CJRS)

Introduced in March 2020 by the UK government, the principle of furlough leave has now been updated into a new Coronavirus job retention scheme (CJRS).

Not only has the new job retention scheme been enhanced for your business, but it's also great for your employees. Working from home isn't always an option for everyone.

The job retention scheme allows you to retain your employees as well as ensure their safety. This is particularly important during the coronavirus crisis, particularly the one we're all facing now. Despite the coronavirus outbreak, the new job retention scheme allows you to avoid unnecessary dismissal of employees and other such redundancies.

So what does furlough leave really mean? And why is it so important for you to comply? How do make sure you comply with the job retention scheme requirements?

More importantly, how can you bring your employers in the job retention scheme?

Let's take a look at each of these questions individually to get a better understanding of what your business needs to claim support from the job retention scheme.

What is furlough leave?

The concept of furlough leave is based on the idea of economic uncertainty.

We live in uncertain, unpredictable times. Your business, as well as your employees, need to be protected.

According to employment laws, furlough leave allows your employees to take a leave of absence during times of economic uncertainty or crisis. When this happens, eligible businesses may claim furlough leave through an online process. After the job retention scheme process is complete, your employees receive 80% of their wages.

This allows businesses to retain employees without having to bear the burden of costs without returns. Simultaneously, employees retain their positions, have some sense of job security despite any temporary setbacks their companies may face.

Though you do not have to bear the weight of paying monthly wages to your workers, you are welcome to pay them the remaining 20% not covered by the job retention scheme. This, however, is not mandatory and employers are free to do so only at their discretion.

Difference between layoff and furlough leave

With furlough leave, there is an understanding that the employee must return after the duration of leave ends. However, with a lay off there is a contrary expectation.

Additionally, an employee who has been placed on furlough leave under the job retention scheme, continues to retain most of their work benefits during the leave period. Thanks to the job retention scheme, they maintain continued access to health insurance.

The job retention scheme offers an alternative to laying off or dismissing employees. It implies an agreement to resume work when possible. There is an understanding that current situations do not permit working in the same manner as before.

Laying off is generally the course of action most businesses take when they are not financially able to support the employees they've hired. This is especially important for companies where remote work is not an option.

It is in your best interest to claim for your employees wages through the Coronavirus job retention scheme to minimize this financial burden while allowing you to retain the employees you need to perform future business tasks when feasible.

Key factors of the job retention scheme

Wondering what compliance means for your business under the job retention scheme? Here are a few things that happen when you bring your employees to the job retention scheme.

- The employee is still on your payroll

- Annual leave is still accrued during this time

- The job retention scheme does not cover fees, bonuses and commissions

- The flexible furlough scheme will be introduced as a new scheme, with the current system coming to a close on 30 June. Employers are free to place employees on the scheme only until June 10th.

- The job retention scheme will cover 80% of your employer's wages up to a maximum of 2500 for staff on furlough leave.

- From July 1st employees may work part-time from on a reduced hours basis, and still be able to claim job retention scheme for the hours the employee isn't working. For example: if an employee is brought back to work for 2 days per week, this means the employer will pay the full salary for those 2 working days, and still be able to claim 80% of the employees' salary for the other 3 days.

- Starting on August, the job retention scheme will still cover 80% of staff wages, but employers will be asked to pay employer national insurance and pension contributions.

- From September on, the furlough support will drop to 70%, with employers expected to contribute the remaining 10%, in addition to the national insurance and pension contributions.

- Lastly, in October, the last month of the job retention scheme will drop again to 60% and employers will be obligated to contribute the other 20% of wages.

These general guidelines will help you get a better idea of what the job retention scheme is and how your business can better manage it.

Job retention scheme requirements in the UK

Can your business apply for the job retention scheme? If you're a UK organization, you most likely can. Consider whether or not you meet the following requirements:

- Did you create a PAYE scheme on or before the 19th of March 2020?

- Did you enrol for a PAYE account online?

- Do you have a bank account in the United Kingdom?

- Is your business negatively affected by the coronavirus outbreak?

- Are you a private organization with no public funding?

- Do you have the consent of employees to put them on furlough leave?

If your answer to all of these questions is yes, then you are eligible for claiming employees's through the job retention scheme.

This, of course, raises a different issue.

Which of your employees' wages can be claimed through the job retention scheme?

Most of your employees should be eligible to benefit from the job retention scheme. Here's what the eligibility criteria for the job retention scheme looks like.

- The employee must be on your PAYE payroll

- Notifications of RTI submissions should be made on or before 19th March 2020

- A contractual employer-employee relationship must exits

Below is the guidelines particular to each type of contractual relationship.

Which employees can be placed on furlough leave?

Wondering what kind of contracts are covered under the job retention scheme? Here's a quick list.

- Any fixed-term employee can be furloughed, however, this is only applicable until the end of their term. If needed you may continue to extend their contract.

- Full-time, part-time employees and agency workers can be furloughed. This includes agency workers who are under the employment of umbrella companies.

- Apprentices can be placed on furlough leave, and you can continue to train them during this period.

- Any officeholder within your organization can be furloughed.

- Salaried company directors can be placed on furlough leave, along with salaried LLP members. However, the same rules of being on your PAYE payroll apply here. However, anyone who is working specifically for commercial revenue is not eligible for claiming wages through the job retention scheme.

- Workers under contract to perform personal services may be furloughed.

Duration of furlough leave

Given that the reason for the new job retention scheme is the coronavirus, there is bound to be uncertainty surrounding the duration. However, while the maximum period may be subject to change, the minimum period of furlough leave is set at three weeks.

Annual leave and work furlough: how do you keep track of both?

You want to maximize productivity, and you fear that all this talk of "leave" jeopardizes your business. However, there are several ways around this.

For one, you can encourage your employees to use their holidays during the furlough leave period itself. Secondly, review your contracts to evaluate whether the leave is a necessary part of the agreement.

However, keep in mind that the EU working time directive allows your employees to carry over at least four weeks of unclaimed annual leave on to the next two years.

Consent and furlough leave

Most employment laws do not specify the need for employers to provide work for their employees. This means that placing your employees on furlough leave without their expresses consent should be legal. However, the breach of contract arises when you are not willing to put in the remaining 20% of their salary.

In this case, you would definitely need their consent because you are going against the agreed payment. In a nutshell, they did not consent to 80% pay, therefore it is a breach of contract.

Ideally, as an employer, it is simply in your best interest to convey a new arrangement to your employees and seek their consent. Not only does it facilitate some form of transparency, but it demonstrates your willingness to take their needs and concerns into consideration.

In addition to this, do ensure that no consent was obtained under duress fraud or threat. In the current economic circumstances, it is highly unlikely for employees to turn down the opportunity for furlough leave. It is simply more prudent to play it safe.

Keep in mind that if your employees are a part of a trade union, it is highly likely that you will have to seek permission through the trade union itself.

As a simple rule for your business, it is always best to do what you think is reasonably expected of you. This will go a long way in helping you avoid any unwarranted legal claims.

Document requirements for the HMRC

Evidence of consent and communication is important for businesses applying for job retention scheme support. This should be documented through some form of written communication, signed agreements or letters.

Now, a back and forth need not be established, however, an acknowledgement is helpful. Be sure to keep the job retention scheme documentation safe for at least five years.

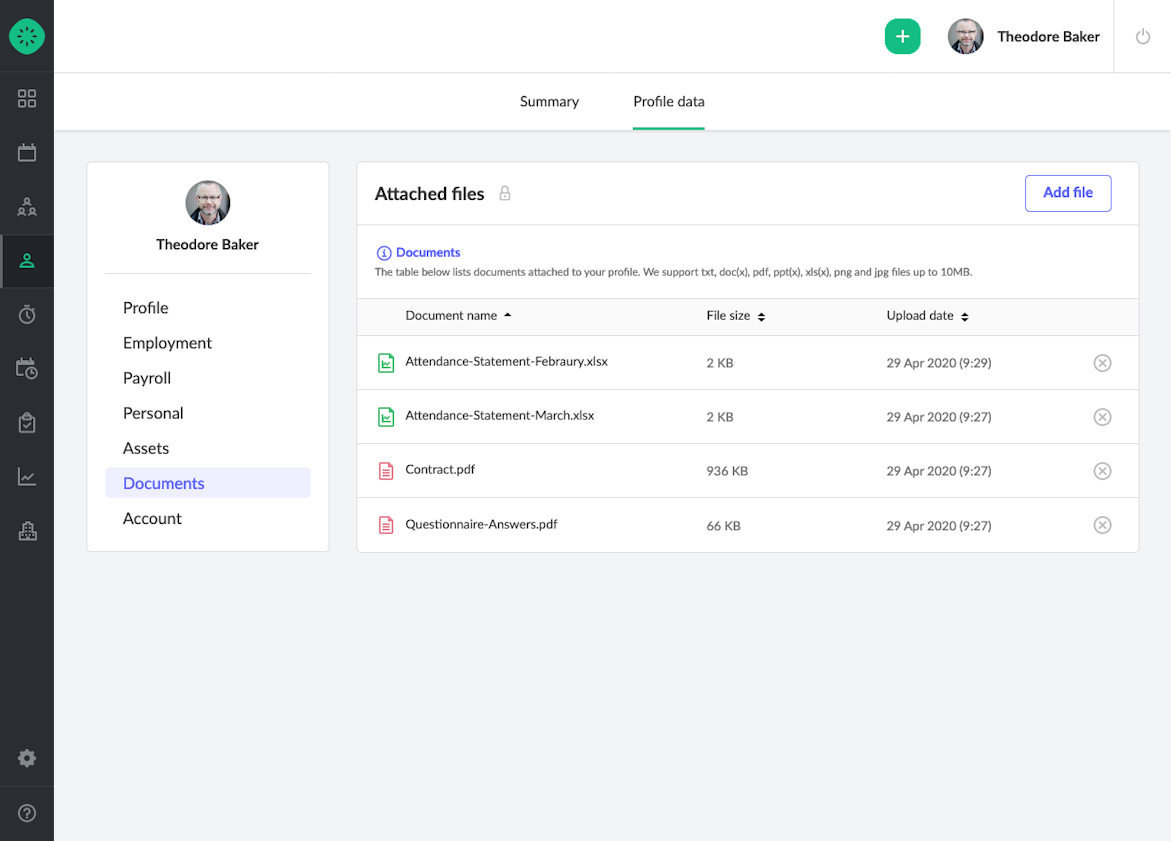

A good HR software like kiwiHR can create safe, digital storage for all important documents.

How Coronavirus impacts your business

It is likely that the job retention scheme rules will be amended subject to the severity of the situation in the months to follow. Remember, the whole reason the job retention scheme exists is to serve as a remedy for businesses and employees in financial need. The pandemic is what brought this into action, and it is what will determine the future course of these events.

The best you can do as an employer is to play it smart, comply with job retention scheme regulations and keep your employees informed of any changes as soon as you hear them.

Additionally, you also need to manage and track your employees' leaves. Do not forget that under the job retention scheme, your employees continue to accrue other types of leave as well.

Addressing Your HR needs

Navigating all these job retention scheme regulations in the midst of the pandemic is no easy task. The pressure is undoubtedly high, and you do not need the added stress of managing furlough leave and annual leave as well.

And that's precisely why you need quality HR software to help you out.

Our software is designed to make your work a lot simpler, and quicker.

Start your FREE 14-day trial and get a taste of what your business needs.

The benefits of using HR software

All these job retention scheme rules and compliance can make it difficult for you to keep track of each individual employee and their respective leaves. That's where HR software can come to the rescue. Here's how it helps you and your business:

- Track all your employees in one convenient location

- Track the amount of time your employees work, including dates, months and years

- Keep track of any time off, sick leaves, annual leave, holidays and so on

- Consolidate all important information within a single space for ease of access

- Make onboarding a seamless experience by using features designed specifically for that purpose

- Track payments due to your employees

HR software is a great way to make sure your employer-employee business runs smoothly and efficiently.

Welcome to our mailing list! We hope you enjoy our content!